Key points

- Thailand’s Electric Vehicles market is projected to reach a revenue of US$1,103.0m in 2024.

- This market is expected to experience an annual growth rate (CAGR 2024-2028) of 5.06%, resulting in a projected market volume of US$1,344.0m by 2028.

- The unit sales of Electric Vehicles market in Thailand are expected to reach 27.32k vehicles in 2028.

- Furthermore, the volume weighted average price of Electric Vehicles market in Thailand is expected to be US$50.5k in 2024.

- Thailand is rapidly emerging as a key player in the electric vehicle market, with government incentives and a growing charging infrastructure driving significant adoption.

Main trends

The Electric Vehicles (EV) market is poised for significant transformations in the coming years. Projections indicate that revenue within this sector is set to achieve a remarkable milestone, reaching an estimated US$1,103.0m in 2024.

However, the EV market’s journey doesn’t stop there. An annual growth rate, calculated as a Compound Annual Growth Rate (CAGR) for the period 2023-2028, is expected to be approximately 5.02%. This trajectory of consistent growth leads to a projected market volume of US$1,344.0 million by the year 2028, reflecting the market’s commitment to expansion and innovation.

As part of this unfolding narrative, another remarkable statistic emerges. By 2028, it is forecasted that Electric Vehicles market unit sales will witness a surge, reaching an impressive 27.3 thousand vehicles. This anticipated boost underlines the increasing adoption and acceptance of electric vehicles as a sustainable and viable transportation choice.

The current EV 3.0 promotional scheme expires in December. An estimated 3 billion baht is being sought for “EV 3.5” promotions in 2024.

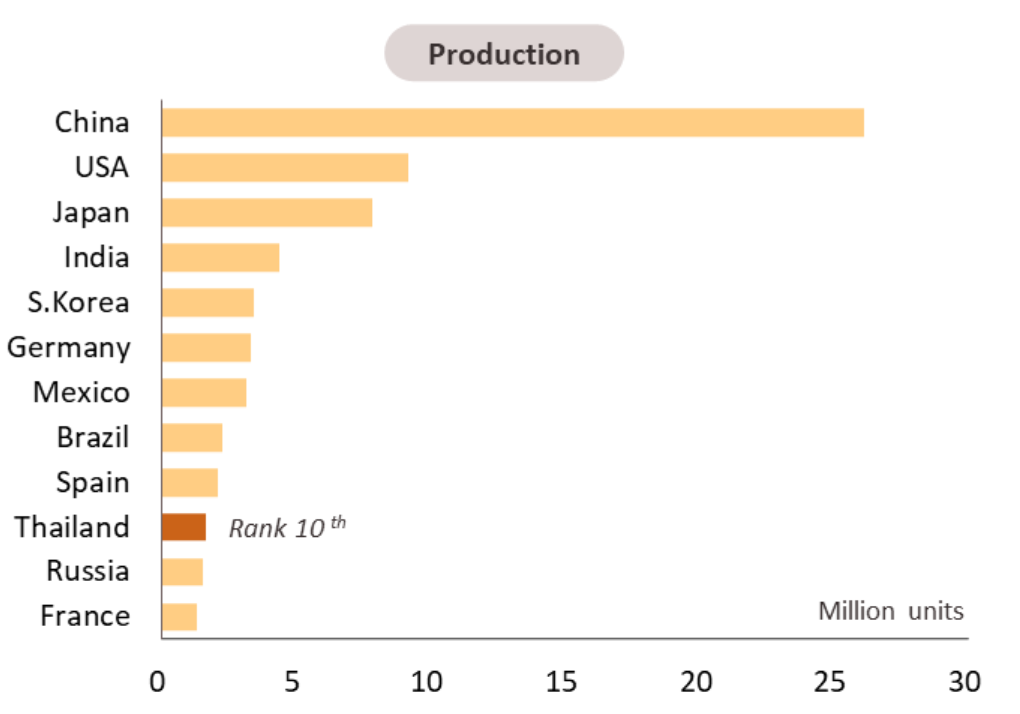

The status of the Thai automobile industry in the global market (2021 data)

It was found that Thailand has the highest production volume of all types of cars, ranked 10th in the world, 5th in Asia, and 1st in ASEAN.

It was found that the Thai automobile market was the 18th largest in the world, the 6th in Asia, and the 2nd in ASEAN. 10th in the world, 5th in Asia and 1st in ASEAN, and if considering the quantitative sales of cars Found that the Thai automobile market is the 18th largest in the world, the 6th in Asia, and the 2nd in ASEAN.

Source : The Federation of Thai Industries (FTI), Ministry of Commerce (MOC), Krungsri Research

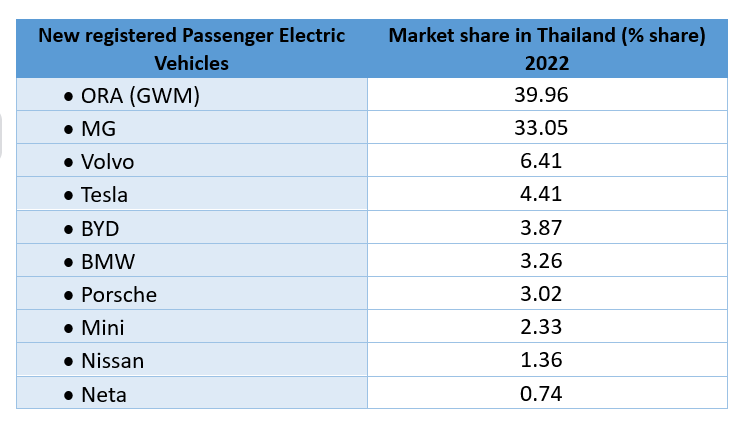

Competitive Landscape

Thailand’s major Electric Vehicles (EV) players.

Commercial Outlook

Isuzu Motors is scheduled to launch its first electric pickup in Thailand in 2025, as the Japanese automaker seeks to maintain its dominance in a market where Chinese automakers are taking the lead in cultivating demand for EVs. The truck is expected to be the first electric version of the D-Max model that is made in Thailand. Isuzu controls about half of the Thai market for pickups, which account for more than 40% of total auto sales.

Thai Smile Bus aims to become the biggest operator of electric buses in Bangkok. The privately owned company plans to almost double the number of electric buses in its fleet of 3,100 and extend its reach to 122 routes. In the first quarter this year, 1,250 of the company’s electric buses operated on 71 routes across the capital.

According to the Electric Vehicle Association of Thailand, Thailand had 1,482 public charging stations as of June 2023, implying there are far too few stations at a time of rapid EV adoption. This could result in willing buyers delaying their EV purchasing decisions as range anxiety concerns are a dealbreaker for many. PTT Oil & Retail Business Plc plans to install 7,000 charging stations by 2030, up from 139 as of January 2023. PTT operates 2,500 petrol filling stations, which will be the foundation for its entry into EV charging.

And, just to remind you, that we at Iconic Research can help with any kind of market research related to EV industry in Thailand.

Trends in Thailand’s Ready-To-Eat Food industry ( forecast period 2023 to 2028 )

/in Uncategorized /by fjipeumyThe revenue generated within the Ready-to-Eat Meals sector reaches a total of $3.9 billion in 2023. Projections indicate an anticipated annual growth rate of 4.65% (Compound Annual Growth Rate) from 2023 to 2028.

Basic information:

Ready-to-eat Food is food that has been processed successfully by using food preservation methods to extend shelf life and processing food products into a form that is ready to eat conveniently divided into 2 types according to the nature of production and storage.

1) Dried and Shelf Stable Ready-to-eat Food accounted for 58.2% of the value of ready-to-eat food in the country.

2) Chilled and Frozen Ready-to-eat Food, accounting for 41.8% of the value of ready-to-eat food in the country.

The ready-to-eat food industry in Thailand has 249 factories registered with the Department of Business Development (latest data as of 2020). Most of them are medium-small factories (SMEs), divided into:

100: dry and rack ready-to-eat food factories (40%)

149: Chilled-frozen ready-to-eat food factories (60%)

The ready-to-eat food industry mainly depends on the domestic market. (average proportion 80-85% of ready-to-eat food production during 2016-2021)

In 2021, ready-to-eat food has a domestic market value of approximately 44 billion baht (divided into dry and shelf ready-to-eat food, 26 billion baht, and chilled-frozen ready-to-eat food, worth 18 billion baht). Exports account for 15-20%, worth US$ 354.1 million (11 billion baht) (2021 data), with the main market in Thailand having the potential to export instant noodles. And chilled-frozen ready-to-eat food, namely, the ASEAN market accounted for 36.2% of the total export value of ready-to-eat food, followed by the United States (13.8%) and the Netherlands (8.4%) respectively.

Competitive Landscape:

Charoen Pokphand Foods (CPF) and S&P Syndicate, two Thai enterprises, secured the leading positions in the industry back in 2015. Thai Beverage (ThaiBev) and Singha Corporation Co., both originating as breweries, have also successfully transitioned into prominent contenders within the ready-to-eat sector.

Instant Noodle Industry:

The market is worth about 2.0 million baht (2021 data). The competition in the country is quite intense among the 3 major instant noodle manufacturers with a combined market share of 86.7% of the instant noodle market value in Thailand.

Consisting of:

– Thai President Foods Plc. under the brand ‘Mama’ (market share 47.6%).

– Thai Food Product Factory Co., Ltd. under the brand ‘Wai Wai’ (23.7%)

– Wan Thai Food Industry Co., Ltd. ‘Yum Yum’ brand (15.4%)

Electric Vehicles Industry in Thailand (2023 to 2028 forecast)

/in Uncategorized /by fjipeumyKey points

Main trends

The Electric Vehicles (EV) market is poised for significant transformations in the coming years. Projections indicate that revenue within this sector is set to achieve a remarkable milestone, reaching an estimated US$1,103.0m in 2024.

However, the EV market’s journey doesn’t stop there. An annual growth rate, calculated as a Compound Annual Growth Rate (CAGR) for the period 2023-2028, is expected to be approximately 5.02%. This trajectory of consistent growth leads to a projected market volume of US$1,344.0 million by the year 2028, reflecting the market’s commitment to expansion and innovation.

As part of this unfolding narrative, another remarkable statistic emerges. By 2028, it is forecasted that Electric Vehicles market unit sales will witness a surge, reaching an impressive 27.3 thousand vehicles. This anticipated boost underlines the increasing adoption and acceptance of electric vehicles as a sustainable and viable transportation choice.

The current EV 3.0 promotional scheme expires in December. An estimated 3 billion baht is being sought for “EV 3.5” promotions in 2024.

The status of the Thai automobile industry in the global market (2021 data)

It was found that Thailand has the highest production volume of all types of cars, ranked 10th in the world, 5th in Asia, and 1st in ASEAN.

It was found that the Thai automobile market was the 18th largest in the world, the 6th in Asia, and the 2nd in ASEAN. 10th in the world, 5th in Asia and 1st in ASEAN, and if considering the quantitative sales of cars Found that the Thai automobile market is the 18th largest in the world, the 6th in Asia, and the 2nd in ASEAN.

Source : The Federation of Thai Industries (FTI), Ministry of Commerce (MOC), Krungsri Research

Competitive Landscape

Thailand’s major Electric Vehicles (EV) players.

Commercial Outlook

Isuzu Motors is scheduled to launch its first electric pickup in Thailand in 2025, as the Japanese automaker seeks to maintain its dominance in a market where Chinese automakers are taking the lead in cultivating demand for EVs. The truck is expected to be the first electric version of the D-Max model that is made in Thailand. Isuzu controls about half of the Thai market for pickups, which account for more than 40% of total auto sales.

Thai Smile Bus aims to become the biggest operator of electric buses in Bangkok. The privately owned company plans to almost double the number of electric buses in its fleet of 3,100 and extend its reach to 122 routes. In the first quarter this year, 1,250 of the company’s electric buses operated on 71 routes across the capital.

According to the Electric Vehicle Association of Thailand, Thailand had 1,482 public charging stations as of June 2023, implying there are far too few stations at a time of rapid EV adoption. This could result in willing buyers delaying their EV purchasing decisions as range anxiety concerns are a dealbreaker for many. PTT Oil & Retail Business Plc plans to install 7,000 charging stations by 2030, up from 139 as of January 2023. PTT operates 2,500 petrol filling stations, which will be the foundation for its entry into EV charging.

And, just to remind you, that we at Iconic Research can help with any kind of market research related to EV industry in Thailand.

Trends in Thailand’s Rice Industry (2023 to 2025 )

/in Blog /by fjipeumyThailand’s Rice Industry Market Size is predicted to show a 3.5% CAGR (The compound annual growth rate) during the forecast period for 2023-2025. Between 2022 and 2024, Thailand’s rice production is predicted to rise due to favorable weather trends, increased rainfall, and sufficient water in dams. The government’s support, particularly through income insurance initiatives, is […]